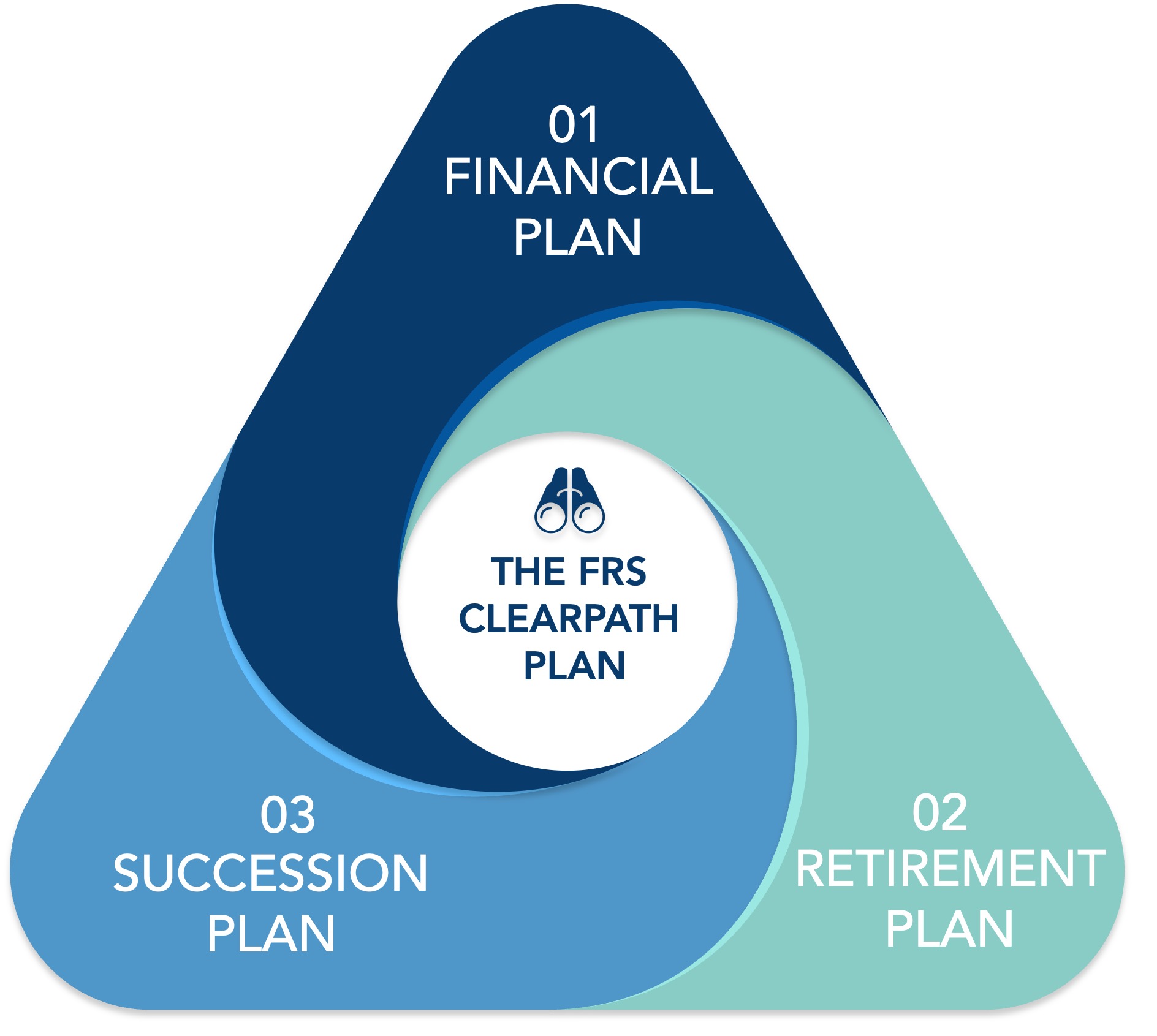

A complete view of your finances creates a clearer path for retirement.

Want to go from foggy finances to clarity and confidence? That's what we do at FRS Advisors.We bring your financial future into focus with our Clear Path View Plan.

The Clear View Plan is our unique approach that clarifies your path forward.

Many people wonder when they can retire, how an economic downturn might upend their portfolio, whether they have enough saved, and how much to disperse their assets to their heirs. Our complete planning approaches encompasses a financial plan, a retirement plan, and an estate plan. Finances go from confused to clear.

When the financial fog lifts, your future is in focus. Financial uncertainty becomes retirement reality, and you'll be more like to enjoy the journey.

Institutional-grade advice and tools for individual clients.

FRS Advisors manages billions of dollars for pension funds, company retirement accounts and institutions that rely on asset preservation and growth. The same institutional-grade advice and tools trusted by these groups to help achieve their goals is also available for our individual clients.

The Clear View Planning Process Steps

- Establish realistic goals.

- Determine discretionary income that can be used towards these goals.

- Develop a plan for discretionary income, which could include:

- Initial home purchase

- College education funding.

- Personal insurance programs (life, disability)

- Retirement funding

- Charitable interests

- Special needs planning

- Develop an investment profile and risk analysis.

- Implement the investment and insurance program.

- Develop an asset allocation model.

- Coordinate tax-qualified and non-tax-qualified investment programs.

- Be comfortable with your personal insurance coverage.

- Coordinate investments and tax planning.

- Identify important legal documents to be crafted (wills, POAs, health care directives).

- Determine if trusts are needed to meet any of the goals.

- Develop a wealth preservation program for legacy planning by considering:

- Proper ownership of assets

- Insurance programs to protect or replace wealth

- Gifting programs

- Trusts for specific intentions or to preserve government entitlements

- Proper beneficiary designations

- Evaluate the plan periodically and amend as life situations and tax laws change.

We provide objective advice on the planning matters and coordinate our work with your other professional advisors, accountant, and attorney.

No two clients are the same, and our work is customized to your particular situation. Therefore, no two financial, retirement, or estate plans are the same.